Earned money is an important part of a company's financial records. It shows the part of the total profit that gets put back into the business, not given out as dividends to people who own shares in this company. This reinvestment can be utilized for different goals like supporting growth, reducing debt, or enhancing operations effectiveness. When we examine retained earnings, it helps us understand the long-term financial status and strategic preferences of a firm. In this article, you will understand what retained earnings mean, how to calculate them, and why they are significant in financial analysis.

Definition and Calculation of Retained Earnings

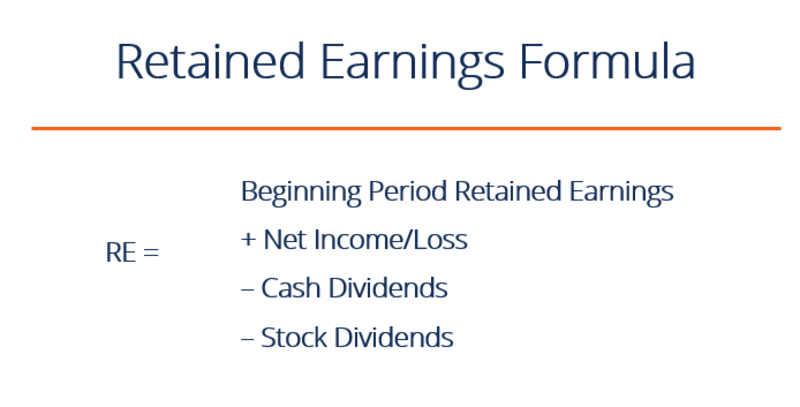

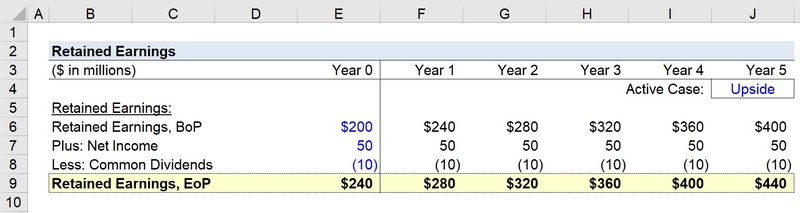

Retained earnings are the total amount of net income that a company has kept over time, minus any dividends given to shareholders. The calculation is simple: begin with the start balance of retained earnings, then include the net income for the period and remove declared dividends. The result shows an ending balance in the company's balance sheet. This math gives a strong understanding of the profit that has been put back into the business throughout its existence.

Stakeholders, both inside and outside the firm, find the retained earnings number very important. Inside the company, it enables management to evaluate how much money can be reinvested back into business. For investors and analysts on the outside of a company's operations, this figure helps them understand its strategy for reinvestment and long-term growth potential. Knowing the method to compute retained earnings and comprehending what it signifies can aid in making knowledgeable financial choices. It also supports the assessment of a firm's monetary path.

- Audit Requirement: Regular audits ensure the accuracy of retained earnings calculations.

- Policy Impact: Changes in dividend policies can significantly affect retained earnings over time.

Importance of Retained Earnings in Financial Analysis

The earnings that a company keeps for itself are called retained earnings. These are important in financial analysis as they show how well it can make a profit and use this to grow further. If the balance of retained earnings is always going up, it means that the company not only makes a profit but also knows how to utilize its earnings efficiently to improve its activities and increase its presence in marketplaces. Those who analyze and invest observe closely the kept earnings as an indicator of growth possibility, finance steadiness, and ability to endure economic recessions.

Additionally, people usually look at the kept earnings together with different important money measurements like return on equity (ROE) and earnings per share (EPS). This gives a more complete understanding of how well the company is doing. When we combine kept earnings with these broader financial analyses, it helps stakeholders to understand how efficiently profits are being used and if there's potential for future profit growth. This full view assists in assessing if the company is experiencing steady expansion.

- Growth Indicator: Rising retained earnings often signal effective reinvestment strategies.

- Risk Assessment: Helps in evaluating a company's ability to sustain operations without external funding.

Implications of Retained Earnings for Investors

For investors, kept earnings are an important part of checking a business's money condition and coming opportunities. Companies that show big earnings often get viewed as having a good chance for growth. This is because they have more money available to put into new plans or creativity. On the other hand, low or no retained earnings might show problems ahead, like not making wise choices in managing a business or not being able to create enough profit. By looking at kept profits in combination with other money measurements, investors can comprehend better where they should put their resources.

Furthermore, the trend of retained earnings can show how well a company is running its operations and making strategic choices. Looking at this analysis can help investors guess about coming dividends and possible increases in capital value. A careful study of retained earnings, combined with other financial information, aids investors in comprehending the complete monetary strategy and danger level of a company.

- Historical Trends: Analyzing past retained earnings helps predict future financial performance.

- Strategic Insights: Reflects managements confidence in reinvestment versus dividend payouts.

Retained Earnings and Dividend Policies

The connection of retained earnings with dividend policies helps comprehend how a company deals with giving returns to its shareholders. Businesses that have a cautious dividend policy usually keep more of their earnings so they can be used for financing growth and expansion activities. On the other hand, firms having an active dividend policy might give out substantial parts of their earnings as dividends to shareholders which reduces the amount available for reinvestment. The extent to which a firm keeps back earnings and gives out dividends can show its strategic focus and capacity for risk-taking.

This equilibrium also affects how investors see a company and its market value. Companies that give importance to keeping earnings can draw in investors who are interested in long-term growth possibilities, but those concentrating on giving out large dividends might be attractive to people focused on income. Knowing this interplay assists stakeholders in matching their investment approaches with the financial policies of the company.

- Investor Attraction: Different dividend policies attract different types of investors.

- Market Perception: Dividend decisions can influence stock price volatility and market confidence.

Retained Earnings and Corporate Growth Strategies

Companies often employ retained earnings to fund different strategies for growth like research and development, mergers or acquisitions, and capital improvements. Plowing back profits into the business can help boost its competitive standing, encourage fresh innovation of products and services as well as broaden the company's market presence. Comprehending how a business employs its accumulated profits gives a valuable understanding of its plans in the long term and dedication toward sustainable expansion.

Furthermore, kept profits act as a financial cushion when an economic decline or less money is coming in. Companies that keep a good amount of retained earnings can make sure they have enough money to handle problems and take chances without depending too much on outside borrowing. This method highlights the significance of strategic planning in utilizing retained earnings for steady expansion.

- Financial Buffer: Acts as a reserve during economic downturns or unexpected expenses.

- Strategic Planning: Effective use of retained earnings reflects strong corporate governance.

Challenges and Limitations of Retained Earnings

Though kept earnings do give a good measure of how well business is doing financially, they still have some limits. One limit is that these earnings don't show if the investments made with them are good or not. A company might have lots of retained earnings but if it invests this money badly then their returns will be less than ideal. Moreover, just looking at kept profits alone does not give full details about how well a company is doing financially. You need to study it with other financial measures and rates to get a complete understanding.

Additionally, too much earnings could show that a firm is not using its money wisely or giving back value to stock owners. This may cause displeasure among shareholders and possibly decrease the worth of the company's stocks. Companies must find equilibrium by keeping earnings for growth while also giving returns to their investors. This helps them keep the trust of shareholders and improve financial results at the best levels possible.

- Capital Efficiency: Excessive retained earnings may suggest inefficient capital use.

- Shareholder Value: Balancing retained earnings and dividends is crucial for shareholder satisfaction.

Conclusion

To end, retained earnings are a crucial part of financial statements that give an understanding of the profit-making ability of a company, and how much is put back into it for future growth and possible expansion. When you study retained earnings, it helps investors and analysts to comprehend better the economic strength as well as the strategic path of a business. The article has explained what kept earnings are and how they get calculated, their significance in financial analysis, effects on shareholders or people who invest money into the company's stock market shares (investors), connection with dividend policies followed by businesses to distribute profits among its owners or shareholders - role played by these kept returns in corporate growth strategies, also limitations and difficulties associated with them. It aids people involved in a business to make decisions with more knowledge and assess its future possibilities better.

What Is Form 6251: Alternative Minimum Tax-Individuals?

Unaffiliated Investments

Selling a Car

Understanding Whole Life Insurance

Top Electrician Insurance Companies: Assessing Coverage and Reliability

How to Evaluate a Stock Using the P/E Ratio and the PEG

For What Length of Time Can a Boat Be Financed?

World's Top 5 Most Expensive Paintings

How to Claim Boyfriend/Girlfriend as a Dependent on Tax Return

What Happens When You Default On A Loan?

Everything You Need to Know About Do-It-Yourself (DIY) Investing?