Whole life insurance is an important tool in planning for financial needs after a person passes away. It offers coverage that lasts a lifetime and comes with many advantages. Knowing the details of whole life insurance greatly helps you to make good choices about your financial future. This article will explain all the parts and benefits of whole life insurance, doing a thorough comparison for you to understand better before making any decisions.

Cost Comparison

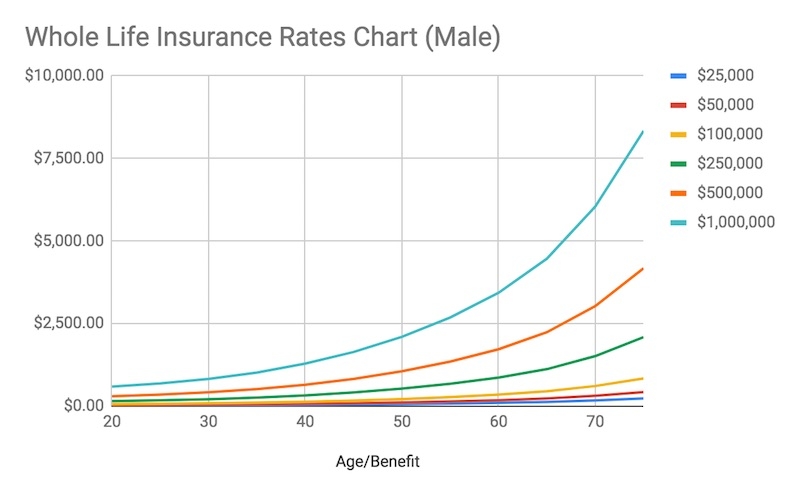

A major factor to think about when looking at whole life insurance policies is the price. Generally, premiums for whole life insurance are more costly than term life insurance because they cover you for your entire life and also have a cash value component. Yet, it is crucial to weigh up the lasting advantages and stability provided by whole-life policies with their initial expenses.

Whole life insurance premiums are usually guaranteed to remain the same over time, giving stability in financial planning and protection against inflationary increases. This steadiness can be beneficial for people who want to get coverage when they're young and maintain lower rates throughout their policy's life span.

- Consideration: Assess the impact of inflation on the purchasing power of fixed premiums over the policy's duration. Adjusting coverage amounts periodically may be necessary to maintain adequate financial protection.

- Caution: Be wary of policies with significantly lower premiums, as they may offer limited coverage or have higher deductibles, potentially leaving you underinsured in critical situations.

Coverage and Cash Value

Whole life insurance provides coverage for the entirety of your life, ensuring financial protection for your loved ones in the event of your passing. Additionally, these policies accumulate cash value over time, which can be accessed through policy loans or withdrawals. Understanding the coverage limits and cash value growth potential of different policies is crucial for selecting the most suitable option for your needs.

Whole life insurance policies have a distinctive feature known as the cash value component. They provide a type of savings or investment in addition to their death benefit. The cash value can be useful for getting money quickly when there's an emergency, or it may act as extra income during retirement which adds to the overall financial safety offered by this type of policy.

- Consideration: Evaluate the projected cash value growth rates and compare them with alternative investment opportunities to ensure optimal returns on your premium payments.

- Caution: Be mindful of the impact of policy loans and withdrawals on the death benefit and overall policy performance. Excessive withdrawals can deplete the cash value and reduce the effectiveness of the insurance coverage.

Guaranteed Death Benefit

Whole life insurance has a very important benefit which is the guaranteed death benefit, which stays as long as you keep paying your premiums. This kind of assurance gives comfort in knowing that when you pass away, your chosen recipients will get a specific amount of money from the policy. It can be helpful to compare guaranteed death benefits from different policies so you can evaluate if they are enough for what you want them to do.

Another attribute linked with whole life insurance is a guaranteed death benefit. This feature assures that the policy's death benefit will be paid out upon the demise of the insured individual, as long as all requirements have been fulfilled correctly. Furthermore, certain whole-life policies allow you to boost your protection by including riders like accidental death benefits or waiver of premium. These enhancements can serve as an extra layer of monetary safeguard in particular situations, giving more assurance to those who hold the policy and their families.

- Consideration: Review the terms and conditions of any additional riders or enhancements to understand their impact on premiums and coverage limits. Choose riders that align with your specific needs and potential risks.

- Caution: Be cautious of policies that offer excessively high death benefits without proper underwriting or risk assessment, as they may come with inflated premiums or limited coverage for certain health conditions.

Dividend Payments

Some whole life insurance policies may give you the chance to get dividends, which are like profits from the insurer's business. These dividends can be utilized for lowering premiums (called premium offset), boosting up your policy's cash value, or taking out payouts in cash. As you compare policies, think about the past of paying out dividends and how this could affect your policy's total worth over time.

The things that affect dividend payments are linked to the insurer's investment portfolio performance and its general financial stability. In addition, policies issued from mutual insurance companies they are owned by policyholders instead of shareholders might have a greater chance of paying dividends because their priority is geared towards benefiting those who hold policies rather than making profits for shareholders.

- Consideration: Evaluate the historical dividend payment track record of the insurer to assess its consistency and reliability. Consider policies with a demonstrated history of dividend payments even during economic downturns.

- Caution: Be cautious of policies that project overly optimistic dividend illustrations, as actual dividend payments may vary based on economic conditions and insurer performance.

Policy Flexibility

Whole life insurance policies frequently provide a variety of options for customization according to personal desires and requirements. These can involve altering the coverage amounts, changing premium payment timings, or appending riders who offer extra benefits. Assessing the adaptability of various policies lets you modify your coverage to match your financial objectives and situation.

Policy loans are a way for policyholders to use the cash value of their insurance policy without giving up on coverage. This option can be helpful in different financial planning situations, like paying for education costs, buying a house, or adding more money to retirement income.

- Consideration: Understand the terms and conditions associated with policy loans, including interest rates, repayment schedules, and potential impact on the policy's cash value and death benefit. Utilize policy loans judiciously to avoid unintended consequences.

- Caution: Be cautious of policies that impose restrictions or penalties on policy modifications, such as surrender charges or lapsation fees. Choose policies with flexible terms that accommodate changes in financial circumstances or life events.

Underwriting and Approval Process

When someone wants to buy whole life insurance, they must go through underwriting first. This is a procedure used by the insurance company to evaluate the risk involved in insuring this person and determine the premium rates. The underwriting process can be different for each insurer, affecting matters such as medical exams, evaluations of health history, and the total time required for approval. Comprehending what's needed in underwriting and how approvals happen can make your insurance application smoother.

Certain insurers provide quicker underwriting programs that use improved data analytics and technology to speed up the application procedure. These programs might not require usual medical exams for suitable candidates, decreasing approval timelines and making the whole insurance buying experience easier.

- Consideration: Explore the availability of accelerated underwriting options and assess your eligibility based on age, health status, and coverage amount. Take advantage of these programs to secure coverage more quickly and efficiently.

- Caution: Be cautious of insurers that offer accelerated underwriting programs with limited coverage options or higher premiums compared to traditional underwriting methods. Compare the terms and conditions of accelerated underwriting programs to ensure they align with your needs and preferences.

Conclusion

In conclusion, comparing whole life insurance policies involves evaluating various factors such as cost, coverage, cash value accumulation, death benefits, dividend payments, policy flexibility, and the underwriting process. By conducting thorough research and understanding the nuances of each policy, you can make informed decisions that align with your long-term financial objectives. Consider consulting with a financial advisor to navigate the complexities of whole life insurance and ensure that your insurance strategy meets your unique needs and preferences.

Best Place to Buy Used Furniture Estate Sales

Top Electrician Insurance Companies: Assessing Coverage and Reliability

The Role of Retained Earnings in Financial Statements

Taxes Must Be Filed by the 2022's End. What You Need to Know If You Still Haven't Filed

A Detailed 2024 Review on USI Affinity Travel Insurance

Everything you need to know about Balance Sheet Equity

Tax Credit for other Dependents

Roth IRA Versus 401(k): A Detailed Comparison

Occidental Life Insurance and Its Benefits for Insurers

Unaffiliated Investments

A Comprehensive Guide to Earthquake Insurance Costs