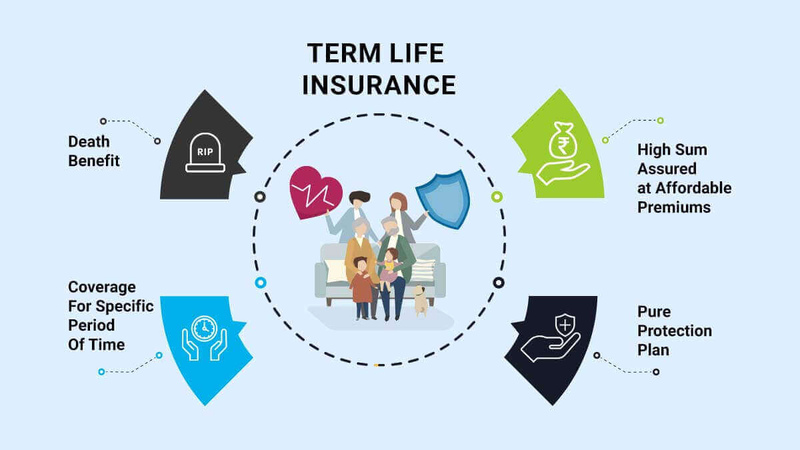

Term life insurance is a kind of life insurance that gives protection for an agreed-upon time, called a term. The difference from whole life insurance is that this kind lasts until the end of the policyholder's whole existence. In contrast to it, term life insurance only covers you for certain years, usually between 10 and 30 years. This article will discuss what is meant by term life assurance, the various types of plans available in the market today, and highlight some advantages it offers to those who have taken out such policies.

What Is Term Life Insurance?

Term life insurance is like financial protection for the people who will get the money if the policyholder dies while their coverage is still active. It's seen as an easy, simple, and low-cost option when compared to permanent life insurance choices. Policyholders have to pay regular amounts called premiums over a certain period in this type of insurance. If the policyholder dies during this period, the beneficiaries get a death benefit. But, if the policyholder continues to live beyond it, there is no payout, and coverage stops.

Term life insurance policies frequently provide extra riders, letting people with the policy personalize their coverage for a more suitable match. These riders might comprise choices like accelerated death benefits that give access to some part of the death benefit if a person holding the policy gets diagnosed with a terminal illness. Moreover, certain policies could contain special riders like waiver of premium which allows suspension or stopping payment for premiums in case there is disability preventing work from being done by the holder of this coverage. These riders can provide added peace of mind and financial protection in challenging circumstances.

- Consideration: Before purchasing term life insurance, consider factors such as the policy's conversion options. Some policies may offer the ability to convert to permanent life insurance without a medical exam, providing flexibility as financial needs change.

- Caution: While term life insurance offers affordable coverage, premiums can increase significantly upon renewal, especially for policies purchased at a younger age. It's essential to budget for potential premium hikes when planning for long-term financial security.

Types of Term Life Insurance

Term life insurance can be found in different shapes, matching various financial situations and necessities. The first type is level-term life insurance which provides an unchanging death benefit amount as well as a premium for the duration of the policy's term. Decreasing term life insurance shows a death benefit that goes down over time, it is good for paying off certain liabilities that reduce in value throughout the years like the mortgage on your home. A type of life insurance that is not so common, but can be beneficial for many people, is known as increasing term life insurance. This option offers a death benefit which becomes bigger as time goes on. It helps to balance out the effects of inflation and rising financial responsibilities in life.

Furthermore, there are term life insurance policies that can be customized by the insurer to fit the changing needs of policyholders. These offers might consist of choices for renewable terms. This means that a person with a policy can increase their coverage time without needing more medical underwriting. It's important to know about different kinds of term life insurance so you can choose one that matches your economic targets and situation.

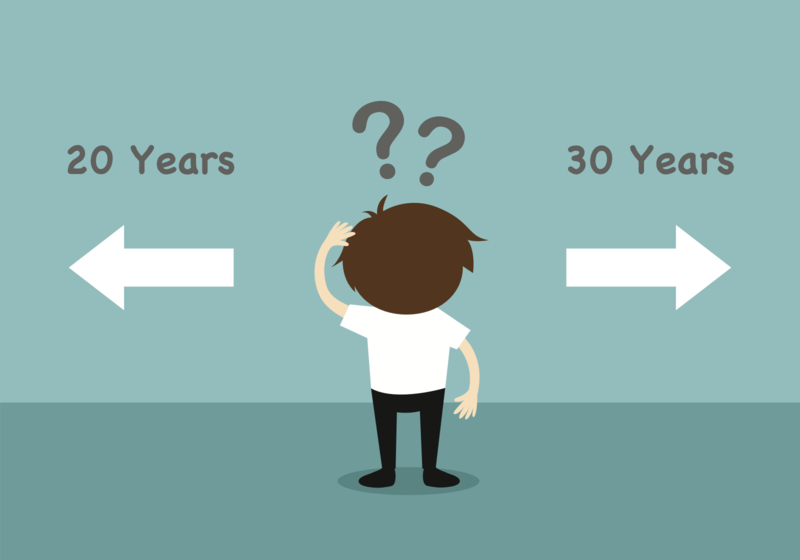

- Consideration: Consider the length of the coverage term carefully. While longer terms may provide extended protection, they often come with higher premiums. Assess your financial situation and future needs to determine the optimal term length for your policy.

- Fact: Term life insurance is often used to provide financial protection during periods of high financial responsibility, such as raising children, paying off a mortgage, or supporting a spouse.

Benefits of Term Life Insurance

Term life insurance is attractive to many people because it has certain advantages. Its affordability makes it possible for a lot of individuals to access, and the flexibility in terms of coverage time and amount also adds appeal. People can adjust their policies to match specific financial duties, like taking care of dependents or paying their debts. Term insurance is also called temporary life insurance. It covers a set period which can be 10, 20, or even more years. If the person who has this policy dies within this period, their beneficiaries will receive a sum of money known as the death benefit. This benefit is usually tax-free and can be used to cover expenses such as funeral costs or paying off debts like mortgages. Term life insurance gives people calmness knowing that their family members are protected financially if something unexpected happens to them and they pass away during the specified time frame on their policy.

Additionally, term life insurance is simple and clear. There are no complex parts related to investment or cash value build-up. The person who has the policy pays premiums for a certain period they choose and, if this person dies within that duration, their beneficiaries get a death benefit. The straightforwardness of term life insurance makes it appealing to people who want basic but dependable safeguarding for those they care about.

- Consideration: While term life insurance offers affordable coverage, premiums can vary based on factors such as age, health, and lifestyle. It's essential to shop around and compare quotes from multiple insurers to ensure you're getting the best rate for your circumstances.

- Fact: Term life insurance is often recommended for young families or individuals with significant financial obligations, as it provides a cost-effective way to ensure financial security for loved ones in the event of premature death.

Choosing the Right Term Length

Choosing the right term length is a very important decision in buying term life insurance. The length of the term should match the policyholder's financial goals and duties, considering factors like age, dependents, debts, and coming expenses. For example, young parents might select a term that gives coverage until their children become financially self-sufficient whereas those owning homes could pick an interval coinciding with the time they have left on their mortgage.

Additionally, one must think about the money required in the future and possible alterations in the situation while choosing a period. Longer terms can give more time for protection but they usually have larger premiums. On the other hand, shorter terms might be cheaper yet could create gaps if your financial duties continue after the policy's end date. Assessment of your present and expected monetary condition could aid in finding the fitting term length for your term life insurance policy.

- Consideration: Take into account any major life events or milestones on the horizon, such as marriage, children, or retirement, when selecting a term length. Your insurance needs may evolve, so choose a term that provides flexibility to adjust your coverage accordingly.

- Fact: Term life insurance is often used to cover specific financial obligations with a defined end date, such as paying off a mortgage, funding a child's education, or replacing lost income during the working years.

Renewability and Convertibility Options

Renewability and convertibility are two common features found in many term life insurance policies. These options give policyholders more flexibility and assurance for the future. A renewable policy lets the holder extend coverage beyond its initial term without needing to do another medical underwriting process. This signifies even if your health has worsened since you bought the policy, still you could renew it for one more term with possibly increased premiums.

Moreover, convertibility choices offer the chance for people having term life insurance to change their policy into a permanent life insurance type like whole life or universal life insurance without needing any medical examination. This can be helpful especially when someone's requirements for insurance shift as they grow older and want coverage that will last their whole lives. It also helps them avoid losing the policy in case of age-related changes or declining health conditions.

- Consideration: When considering renewability options, it's essential to understand how premiums may increase upon renewal. While renewable policies offer the convenience of extending coverage without requalifying medically, the resulting premiums may be significantly higher, especially as policyholders age.

- Fact: Convertible term life insurance policies typically have a conversion period during which policyholders can exercise this option, usually within the first few years of the policy's term. After the conversion period expires, policyholders may no longer be eligible to convert their coverage.

Evaluating Premiums and Coverage Amounts

For term life insurance, it is very important to compare the premiums and coverage amounts. Premiums for term life insurance depend on different things such as the person's age, health condition, way of living, and how much coverage they choose along with the length of the policy. Normally, younger healthier people have less expensive premiums while older people or those with existing health issues might need to pay more money each month toward their policy premium costs.

Also, the coverage should be enough to substitute the policyholder's income and settle existing debts. It must account for future costs like mortgage payments, college fees, or ongoing living expenses of dependents. You can decide how much coverage is needed by thinking about your household earnings, savings, and investment accounts already in place as well as debts not yet cleared up plus expected forthcoming expenses such as paying mortgages each month along with college tuition fees or continuing living costs for those who rely on you financially. Make sure you do a detailed study of your money situation so that the temporary life insurance policy gives enough safety to people dear to you.

- Consideration: Some term life insurance policies offer the option to add riders for additional coverage, such as accidental death benefits or critical illness riders. These riders can provide added financial protection in specific circumstances but may increase premiums.

- Fact: Term life insurance premiums are typically level for the duration of the policy term, meaning they remain the same each year. However, premiums can increase significantly if the policy is renewed at the end of the initial term, especially if the policyholder's age or health has changed.

Conclusion

Term life insurance is a simple and economical way to protect your family financially if you pass away. Knowing the kinds of term life insurance, deciding on the correct length of term, as well as looking at premiums and coverage amounts will help make thoughtful choices that match your financial goals. This full guide has been made for you to understand all about term life insurance. It gives information on how different options work and their benefits so that when selecting a policy, it matches perfectly with your needs.

Top Electrician Insurance Companies: Assessing Coverage and Reliability

A Comprehensive Guide to Earthquake Insurance Costs

All About Test Driving of a Car

How to Make Money Using TikTok Shop: A Beginner's Guide

All About the Energy Price Cap

Best Place to Buy Used Furniture Estate Sales

From Coverage to Claims: A Complete GEICO Life Insurance Review

Insurance Companies for People Over 50

Best Business Loans for Bad Credit

Selling a Car

Roth IRA Versus 401(k): A Detailed Comparison