That is a surprising revelation from a financial institution, but it cannot be denied. The choice to hoard cash, even though one knows one might put that cash to greater use, is frequent and reasonable. But, it is not a sensible one.

I am responsible for investigating the reasons behind people's illogical choices and thinking about how these choices may be reframed to get more favorable results. In light of this, let's examine why so many of us hoard excessive cash.

Loss aversion

One of the strong factors in behavioral finance is loss aversion, which describes the phenomenon in which we are more driven to avoid loss than we are to achieve gain. The elation of gaining twenty dollars only equals the anguish of losing ten dollars.

The fear of losing everything because the market has peaked is an example of loss aversion. Since we are concerned about having it taken away, we do not invest any of our cash. Yet when we do nothing with our cash, we risk losing something even more important: our ability to make purchases.

It is anticipated that keeping cash on hand would result in a decline in buying power over the following several years

Even if the balances in our accounts remain unchanged, the purchasing power of that money will decrease if the economy continues to expand and prices continue to increase. In addition, we are making less progress on our long-term objectives. A strategy for investing may be significantly hampered by idle cash due to the "return drag" it causes. In the same way that investing may result in compound interest, failing to invest can result in compound losses over time.

If we have devised a plan to assist in achieving certain objectives, such as paying for a child's wedding, a family safari, house improvements, or retirement, then the possibility of suffering a loss arises if we do not utilize all of our resources to achieve these objectives. Such losses aren't simply figures; they're floral arrangements at the wedding, an additional weekend in Africa, or a pool for the grandchildren. Those are all things that can't be replaced. Those are the specifics of our waking fantasies.

We will, of course, want to have some cash on hand to ensure that our expenses are met for the next year or two and give ourselves a sense of psychological security. Under the context of our framework for goals-based planning, liquidity and cash is one of many "buckets" that make up an overall wealth strategy.

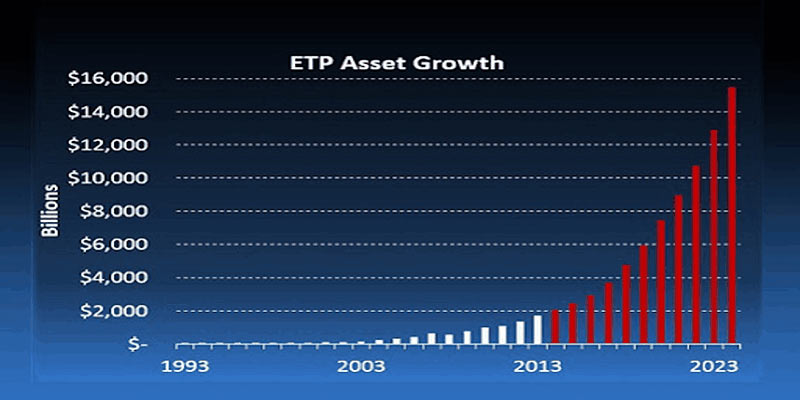

Maintaining a sizable cash reserve makes many of us feel more at ease taking on risk across the remainder of our investment portfolio. At this time, one of the risks we can take is investing cash when the market is at an all-time high. Given that we know it is impossible to time the market, we cannot guarantee that we are not now at a high. Yet we should remember that even if we invest when the market is at its highest point, there is a good chance that our investments will pay off in the long term.

Imagine you made investments at the worst possible times throughout the year. What would have happened?

Bloomberg Finance L.P. used daily returns as the source. As daily observations were first collected for the Bloomberg Barclays U.S. Aggregate Index on January 2, 1989, the data shown here covers the period from that date through December 31, 2021. The Balanced Allocation rebalances itself every quarter, comprising 55% of the S&P 500 and 45% of the Bloomberg Barclays U.S. Aggregate Index.

Present bias

What should we do if we start to feel seasick? We turn our attention away from the waves rocking the hull to focus on the stillness and steadiness of the far horizon. While navigating treacherous financial seas, the same strategy should be used.

The idea known as present bias explains why, for many of us, the here and now is more important than what happens in the future. The feelings of the here and now far surpass the possibilities the foreseeable future holds. We see our future selves as being entirely distinct individuals from ourselves. Doing something here and now produces a positive emotional reaction, but planning for the future produces little response. Because of this, engaging in behaviors that will benefit us in the future, such as engaging in physical activity, maintaining a good diet, or letting go of our financial holdings, is very challenging. It simply seems better to be connected to our cash now rather than the consequences of our investments in the future. So, what options do we have?