Foreign Institutional Investors (FIIs) are a type of investor or investment fund that makes financial investments in a country different from where they are based or have their main office. This term is often associated with India, which describes international entities investing in the country's financial markets. China also officially uses this term.

FIIs encompass a variety of financial entities, such as hedge funds, insurance companies, pension funds, investment banks, and mutual funds. These investors are pivotal in bringing capital, especially to developing economies. However, countries like India regulate the extent of their involvement. They limit the maximum value of assets an FII can acquire and restrict the percentage of equity shares they can hold in a single company.

Such regulations aim to moderate the impact FIIs have on individual companies and the broader financial market of the host country. It's also a measure to mitigate potential risks, like the destabilizing effect that could occur if FIIs withdraw their foreign investments suddenly during a financial crisis.

Foreign Institutional Investors Features

Institutional Characteristics

Foreign Institutional Investors (FIIs) are characterized by their institutional nature, distinguishing them from individual investors. They are specialized entities managing significant funds, often aggregating resources from multiple clients or shareholders.

Cross-Border Investment Approach

FIIs are known for their cross-border investments. They venture into international financial markets, focusing on assets such as equities, bonds, government securities, and other financial instruments in the host country, like India.

Portfolio Investment Strategy

FIIs primarily focus on portfolio investments. This approach involves acquiring and maintaining diverse securities portfolios to generate returns for their clients rather than seeking controlling stakes in particular companies.

Diversification for Risk Management

A key strategy of FIIs is diversification. They spread their foreign investments across various asset classes, industries, and geographical areas to balance risk and optimize returns.

Professional Management and Expertise

FIIs employ teams of experienced financial professionals and analysts. These experts conduct thorough research and analysis before making investment decisions backed by substantial resources and information.

Regulatory Compliance

Operating within a strict regulatory framework is essential for FIIs. They adhere to the regulations of their home country and the host country where they invest. Regulatory bodies in the host countries often set specific rules and guidelines to govern the activities of FIIs.

FIIs Different Types

Sovereign Wealth Funds (SWFs)

They are state-owned investment entities established by national governments. Their primary role is to manage and grow a country's surplus reserves and wealth, often for future generations or to fund various national projects.

Foreign Government Agencies

These agencies or entities are directly owned or controlled by foreign governments. They invest in international financial markets with objectives like generating returns, stabilizing foreign exchange reserves, or fostering diplomatic and economic relationships.

International Multilateral Organizations

IMOs involve multiple countries and are focused on tackling global economic and financial challenges. They extend financial assistance, encourage development, and promote stability among their member and non-member nations.

Foreign Central Banks

These are the central monetary authorities of various countries. Their primary functions include managing foreign exchange reserves to ensure exchange rate stability, facilitating international trade, and maintaining overall economic stability.

Advantages

Capital Inflow and Economic Growth

FIIs are instrumental in channeling significant foreign capital into host countries. This influx acts as an economic growth stimulant, providing businesses with the resources needed for expansion and innovation.

Enhanced Corporate Governance

FIIs often push for better corporate governance practices in the companies they invest in. Their influence promotes transparency and accountability, raising the standards of corporate governance.

Boost to Foreign Exchange Reserves

The entry of foreign currency via FIIs contributes to the host country’s foreign exchange reserves, which are crucial for maintaining exchange rate stability.

Economic Development

Investments by FIIs and qualified foreign institutional investor lists can lead to job creation and infrastructure development, triggering positive ripple effects across the economy.

Disadvantages

Dependence on Capital Inflows

An over-reliance on FII investments can make a host country vulnerable to economic shocks, as its stability becomes tightly linked to investor sentiment shifts.

Risk of Foreign Control

Substantial investments by FIIs can raise concerns over foreign influence or control over local companies, leading to questions about economic sovereignty.

Speculative Behaviors

FIIs may engage in speculative trading, potentially leading to market volatility and contributing to the formation of asset bubbles.

Short-Term Orientation

FIIs often focus on short-term returns, which can prioritize immediate gains over long-term economic stability or development.

Impact on Exchange Rates

FII activities can influence foreign exchange markets, leading to currency fluctuations that may affect international trade and financial stability.

Rise of Foreign Institutional Investors in Global Finance

Growth in the Late 20th Century

The 1980s and 1990s marked a significant increase in cross-border investments, establishing FIIs as key players in global financial markets, particularly in emerging economies.

Deregulation and Market Liberalization

This period saw many nations, especially emerging markets, implement economic reforms and liberalization policies. These changes were aimed at attracting foreign capital, and offering FIIs new investment opportunities in previously restricted markets.

Portfolio Investment Strategies

FIIs focused predominantly on portfolio investments involving the purchase of stocks, bonds, and other financial assets in overseas markets. Their investments brought substantial capital into these markets, significantly impacting asset prices and market liquidity.

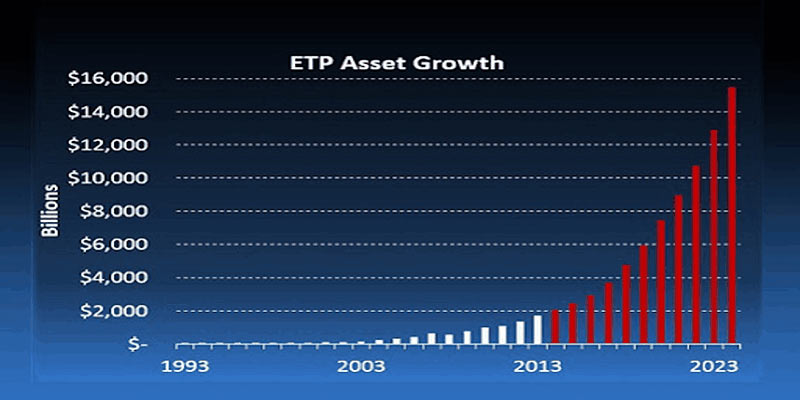

Global Market Integration

With FIIs consistently investing in foreign markets, the global financial system has become more interconnected. The flow of information improved, and financial instruments like exchange-traded funds (ETFs) made cross-border investments more accessible.

Effects on Host Countries

The entry of FIIs into host countries brought both benefits and challenges. While they provided much-needed capital and liquidity, their presence also introduced market volatility and the risk of rapid capital withdrawal, potentially affecting exchange rates and local market dynamics.

Bottom Line

Foreign institutional investors are active players in a dynamic financial drama. Global tendencies, legislative developments, and economic factors affect their whereabouts, choices, and actions. To successfully navigate the current financial world, it is essential to have a thorough understanding of their function and the subtleties of their interaction.

Knowledge of FIIs and their effects is important for investors, regulators, and everyone interested in the financial markets. A well-informed strategy may help people and governments reap the rewards while minimizing the dangers as FIIs change economies and impact markets.